Elon Musk at the SpaceX rocket testing site in McGregor, Texas

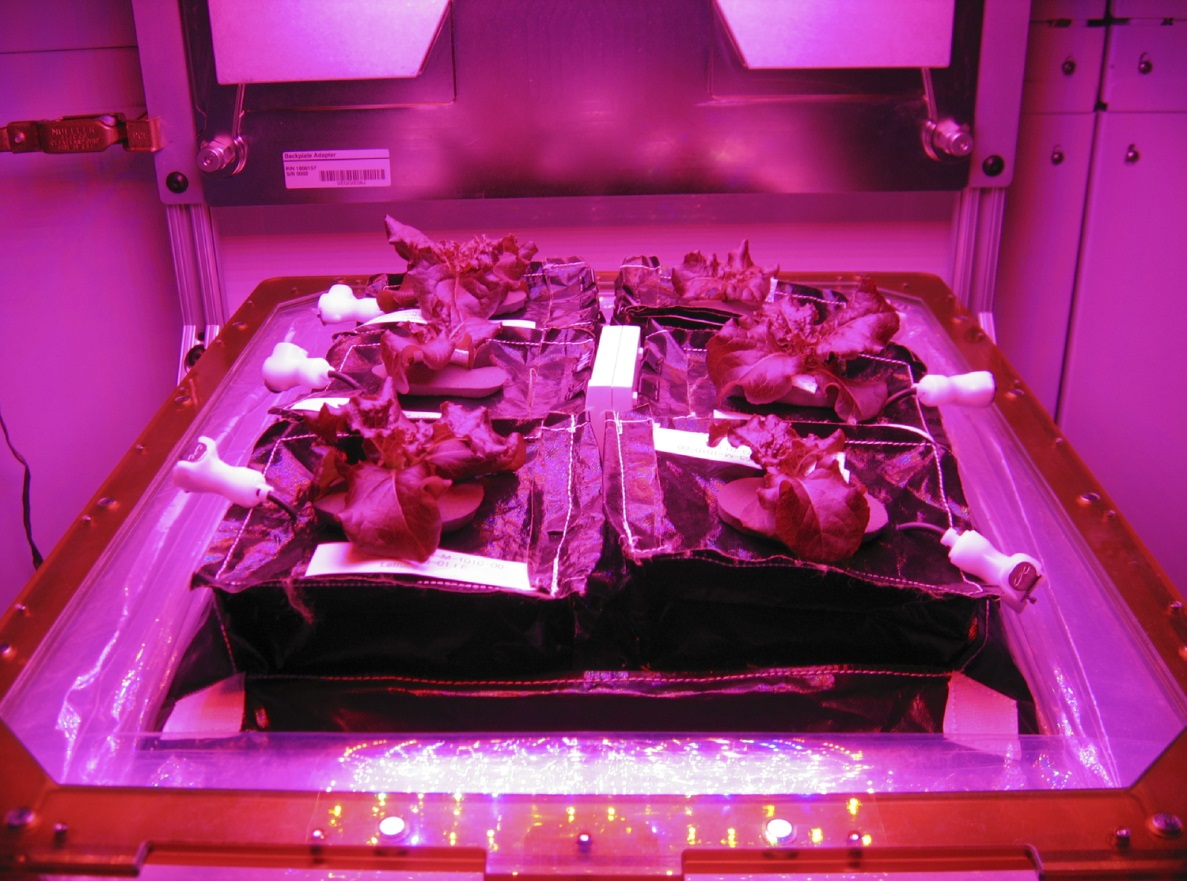

Elon Musk has a flare for stirring up interest in pretty much everything he does. Even the prospect of hiring a farmer is national news, given Musk’s dream to colonize Mars.

So when SpaceX announced it was hiring a farmer… well, it’s easy to jump to conclusions.

Of the 600+ acres that SpaceX leases from the city of McGregor and Texas A&M University, only about 127 are dedicated to rocket testing, according to the McLennan County Appraisal District, which oversees the area that includes SpaceX test site. The rest of the land is farmland that acts as a buffer for potential rocket explosions.

None of the land at the SpaceX test site is zoned for agricultural use, even though “farmers have been on that land for a number of years,” says McLennan agricultural appraiser Matt Davis.

SpaceX., which has not responded to questions about its farming program, may just want to have greater control over the farmland buffer around its test site.

From the job post:

This position will be required to work around test schedules as necessary to ensure the successful crop production does not interfere with testing progress.

According to Mike Farah, a real estate lawyer specialized in farm and ranch law, “it could be as simple as they have a lot of land and they are looking for someone to manage it.”

How Texas ranchers avoid property taxes

There is a loophole in the Texas tax code that allows ranch owners to pay taxes on agricultural production instead of on the value of the land.

That is, if your $20 million ranch only yielded $20,000 in alfalfa last year, you’re only paying taxes on that $20,000, rather than Texas’ higher-than-average property taxes on the full value of the land.

“You’re talking about a major, major economic boost,” Farah said.

Farah, who manages several high net-worth clients, said it is common practice to maintain some farm activities in order to avoid property taxes.

“It’s a very safe place to place many millions of dollars, have that property grow in value and not pay very high taxes to keep it,” Farah said. “There’s nothing shady about it.”